Free Paycheck Calculator for All 50 States

See your exact take-home pay after federal and state taxes. Works for hourly wages and annual salaries. Updated for 2026 tax brackets.

Free download•No account required•Works offline

Calculate Your Net Income in 3 Taps

Enter your gross pay, select your state, and see how much you'll actually take home. Includes federal taxes, state taxes, and all deductions.

Easy Income Entry

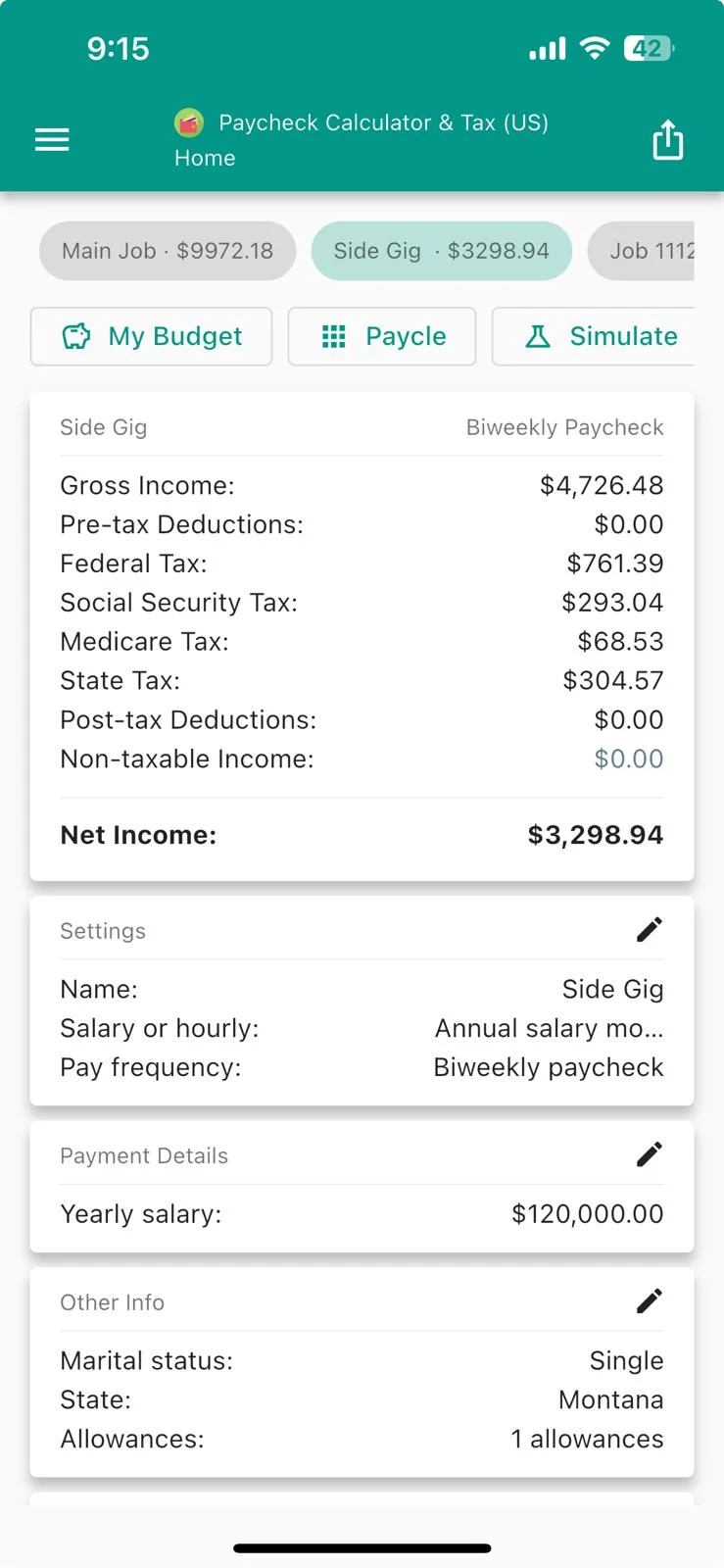

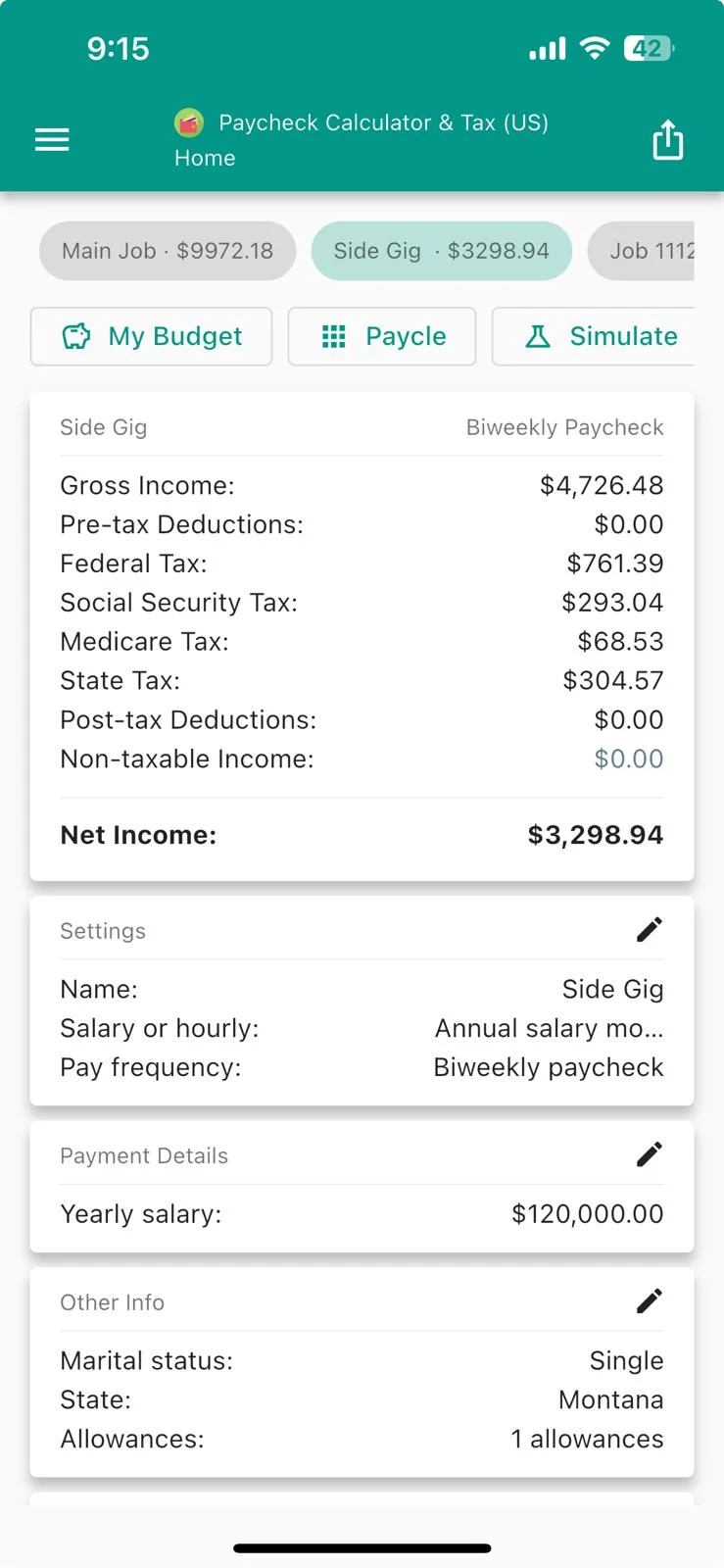

Easy Income Entry Detailed Tax Breakdown

Detailed Tax Breakdown Manage Deductions

Manage Deductions Clear Results

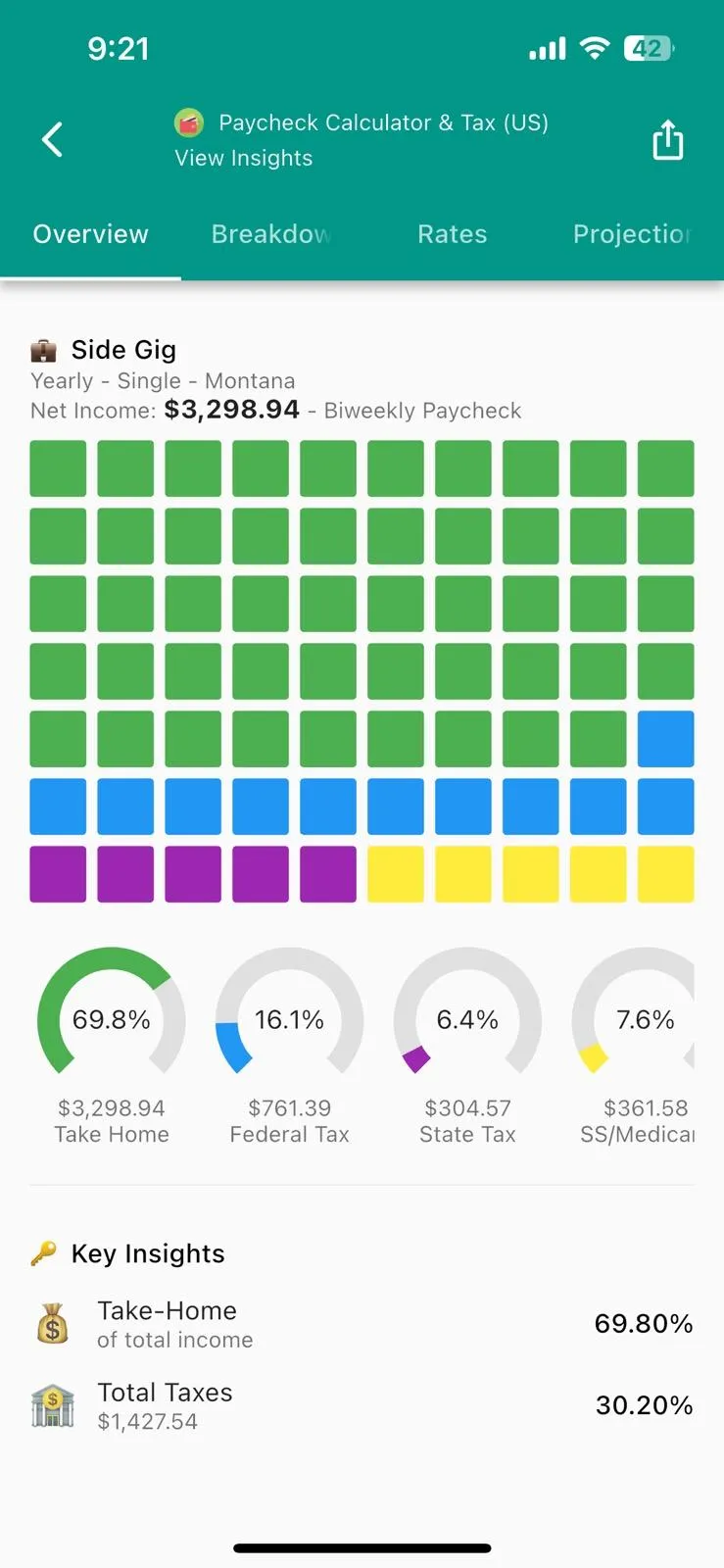

Clear ResultsThe Most Accurate Take-Home Pay Calculator

Built for accuracy and trusted by 500,000+ workers. Calculate your net income for any scenario.

Accurate to the Penny

Calculate your net income with precision. See results update instantly as you enter your hourly wage or annual salary.

Federal & State Taxes

Covers federal income tax, Social Security, Medicare, and state taxes for all 50 states plus DC. Updated for 2026.

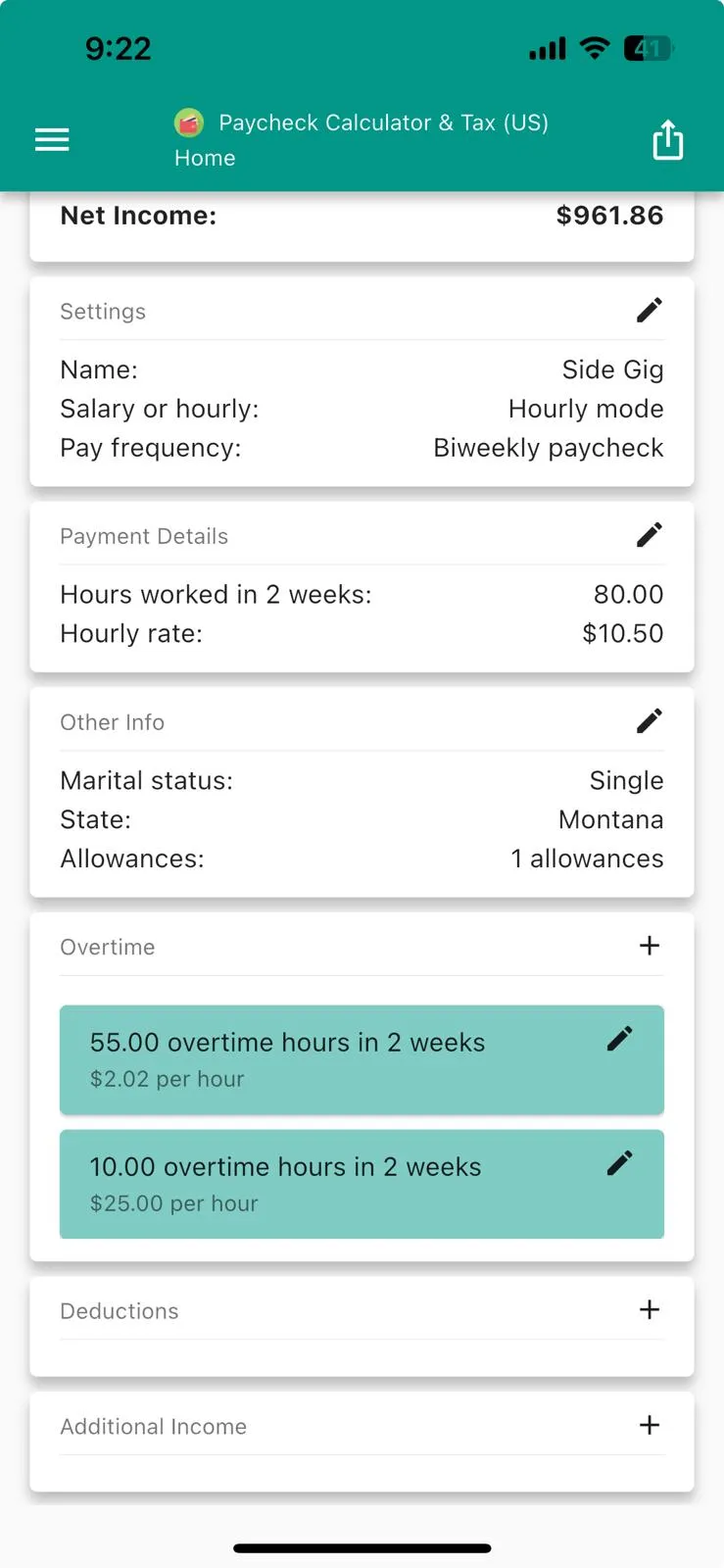

Overtime & Bonus Pay

Add overtime hours at 1.5x, 2x, or custom rates. See how extra shifts and bonuses affect your take-home pay.

Pre-Tax Deductions

Model 401(k), HSA, FSA, and health insurance deductions. See exactly how each reduces your taxable income.

Weekly to Annual

Switch between weekly, biweekly, semimonthly, monthly, or annual pay periods to match your employer.

100% Offline & Private

All calculations happen on your device. No account, no tracking. Your salary information stays private.

Monthly Budget Planner

Combine multiple paychecks with custom income and expenses. See visual breakdowns with waterfall charts and spending allocation.

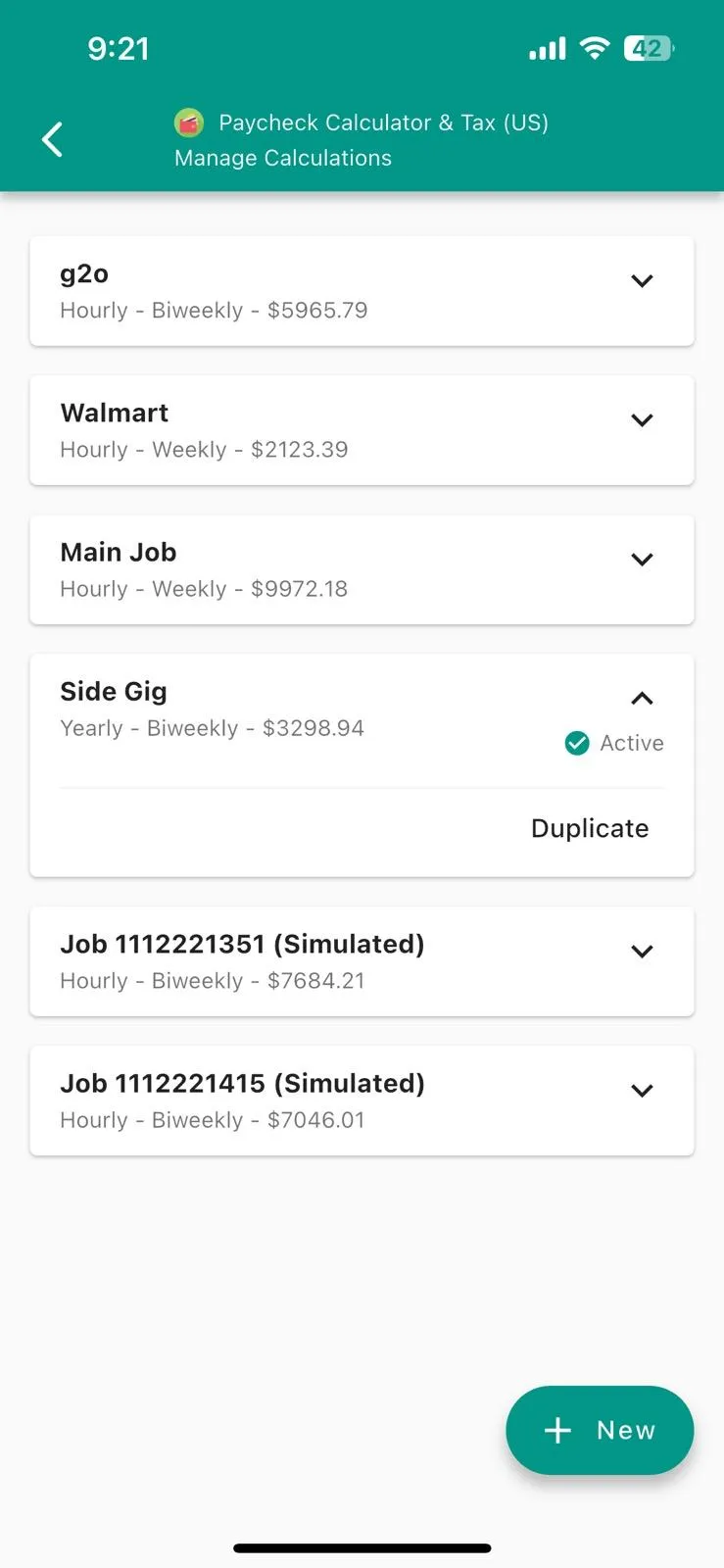

Compare Job Offers

Side-by-side comparison of saved calculations. Compare hourly vs salary positions with normalized yearly net income.

Simulate Scenarios

Preview the impact of salary changes before committing. See deltas for gross pay, taxes, and net income instantly.

Trusted by 500,000+ Workers Nationwide

See why people trust Paycheck Calculator US for their financial planning.

"I love the simplicity and barebones productivity of this app! It has one assignment and does it exceedingly well. I use it to quickly and accurately predict my paychecks based on hours worked, including overtime. Outstanding for financial planning!"

"Very accurate! When I first used the app and put in my info, it was so close to what I was actually paid! Almost down to the last penny! The app is very easy to use, has a simple UI. I also love how it takes local and state taxes into account."

"I've been using this app for years and it's never let me down. I suggest this app to everyone looking to get an estimate of your paycheck. Since I've been using it, it's only been maybe five dollars off. All in all, great app."

"I love this! It's a simple calculator, doesn't ask to link your bank account. You can enter numbers from your last pay stub, then change hours to see gross/net. It's accurate, reliable, doesn't glitch. I've been using it for 6 months... love it!"

"My friend does taxes and recommended this to determine what my checks might look like. It honestly really helped. It's not 100% accurate but it's only ever off by coin amount, and if more, the most I've noticed is about $50."

"Been using the same app for years, it's pretty much moved in as an essential. Takes care of all the taxes and shows your gross vs actual paycheck. Not much else to say lol just works and has never had any issues."

Frequently Asked Questions

Does this paycheck calculator work for hourly and salaried workers?

Yes. Switch between Hourly and Salary modes instantly. Calculate your take-home pay whether you're paid by the hour or earn an annual salary.

What pay frequencies does the calculator support?

Choose from Weekly, Biweekly, Semimonthly, Monthly, Quarterly, Semiannual, or Yearly schedules to match how your employer pays you.

How accurate is this paycheck calculator?

The calculator uses current federal tax brackets, Social Security and Medicare thresholds, and all 50 state tax tables so your net income estimate stays accurate.

Can I calculate how 401(k) and HSA affect my paycheck?

Yes. Add unlimited pre-tax and post-tax deductions including 401(k), HSA, FSA, and insurance to see exactly how each affects your take-home pay.

How do I calculate overtime pay and taxes?

Add overtime entries with 1.5x, 2x, or custom multipliers. The calculator shows how overtime increases your gross pay and the taxes withheld.

Does the calculator include bonuses, tips, and commissions?

Yes. Track supplemental income alongside regular wages and mark items as taxable or non-taxable for accurate withholding calculations.

Will my paycheck calculations be saved?

Your inputs auto-save locally after one second of inactivity, so the app reopens with every deduction and overtime entry intact.

Is my salary information private?

All data stays on your device. No account, no tracking, and the calculator works entirely offline for maximum privacy.

Paycheck Guides & Tax Resources

Master withholding, overtime, and every part of your paycheck.

Top Paycheck Calculators 2026

Compare the best paycheck calculator apps and tools available today.

How to Fill Out the 2026 W-4

Step-by-step through the latest form with real examples so your withholding stays accurate.

How 401(k) Changes Net Pay

See how traditional and Roth 401(k) deposits shift taxable wages and what to adjust.

Overtime and Bonus Tax Methods

Compare flat-rate versus aggregate withholding on supplemental pay.

Paycheck 101: Gross vs. Net

Understand every deduction and how they reduce your take-home pay.

Try the Free Paycheck Calculator

The #1 rated paycheck calculator on iOS and Android. Free download, no account required, works completely offline.